Household equity: Analysing the impacts of Scottish parties' tax proposals

Household equity: New IPPR analysis identifies the winners and losers from Scottish parties' tax proposalsArticle

With only three months to go until the Scottish parliament elections, we are beginning to see glimpses of what tax plans might be in the political parties’ manifestos. With the financial arrangements underpinning potential new powers for Scotland still being negotiated between the UK and Scottish governments, and with the Scottish parliament’s budget not finalised until later in February, there are a few hurdles to jump through before we get to the election, but we have analysed the effects of these potential policies over the course of the next Scottish parliament, to 2020/21.

Scotland’s political parties have been busy looking at how Scotland’s current and potential tax powers could be used; busier than we have seen for some time. And all sides have been keen to define their own proposals as progressive or their opponents’ as regressive. This is as much about Scottish political language as a technical description, with all parties wishing to be described as ‘progressive’. In Scotland, it seems, progressive equals good and regressive equals bad, across the political spectrum. As Scotland’s new independent, cross-party progressive thinktank, we obviously see this as a laudable aim.

So far we have seen some initial income tax policies from the Scottish Liberal Democrats and Scottish Labour. We have also seen some potential ideas from the Scottish Conservatives’ Independent Tax Commission, with proposals to at least match the tax take of the rest of the UK in Scotland. Interestingly, deliberately or not, all these proposals would work as well under existing powers as they would under the new tax powers potentially coming to Scotland.

IPPR Scotland will publish an in-depth report looking at tax and benefits next month. In advance of its release, we have used IPPR Scotland’s tax and benefit model to analyse the effect of the three proposals in terms of who would win and lose in financial terms across the income spectrum, and to track that to 2020/21, the last year of the next parliament.

We have compared the three proposals against a ‘baseline scenario’ in which the personal allowance rises to £12,500 as planned by the UK government, and the gap between the higher-rate threshold and the personal allowance increases with inflation (CPI).

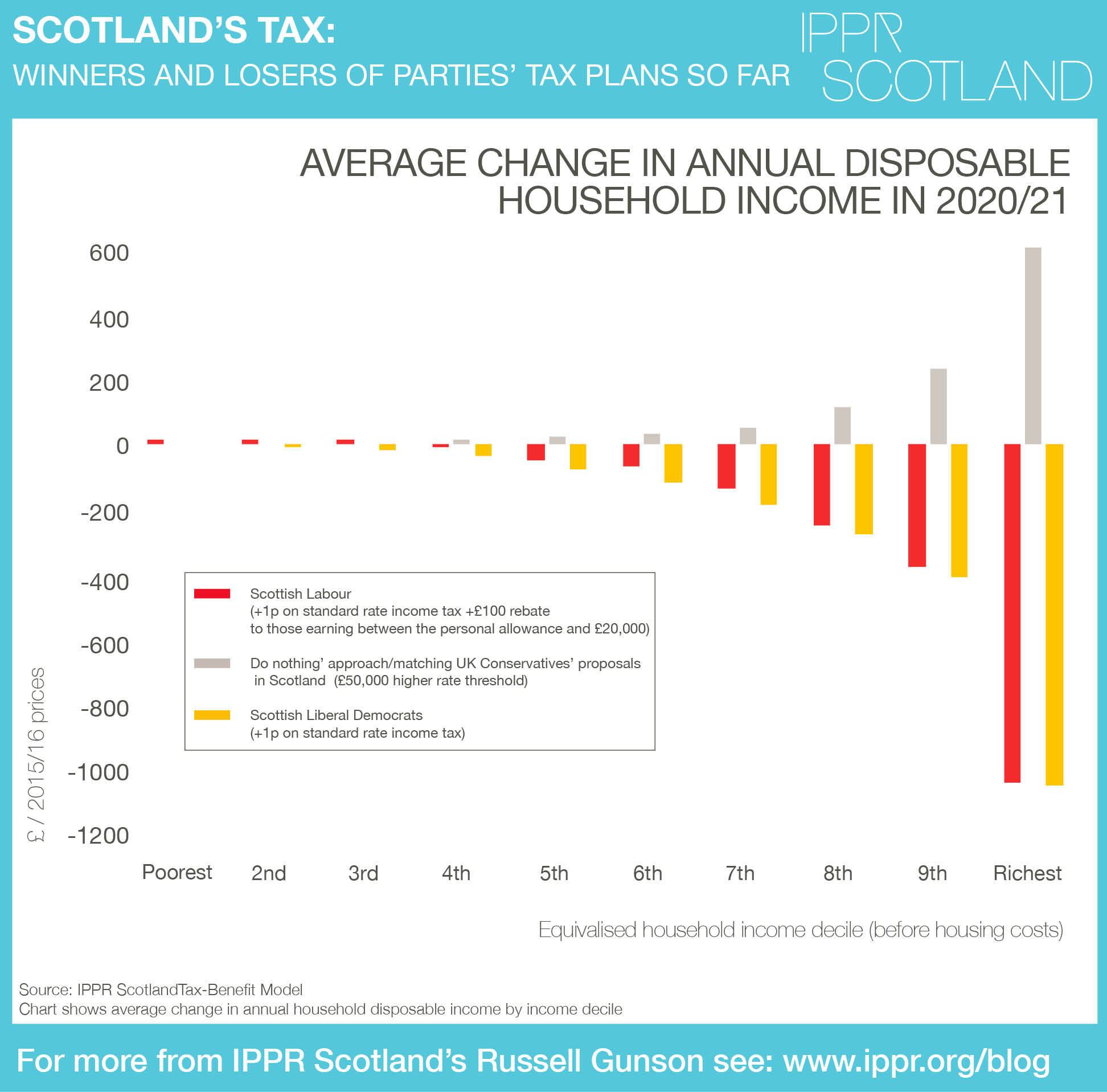

Figure 1 Modelling the effects of Scottish parties’ tax proposals

Average change in annual disposable household income in 2020/21 (2015/16 prices), by equivalised household income decile (before housing costs), for Scottish Lib Dems, Scottish Labour and UK government ('do nothing') scenarios

- The Scottish Liberal Democrats are proposing to increase the Scottish rate of income tax by 1p, in effect raising the basic rate, additional rate, and higher rate of income tax by 1p in the pound. This proposal produces a large increase in taxes for the richest – the top-earning households would pay £1,050 extra per year – and at least marginal tax increases for all but the poorest 10 per cent of households.

- Scottish Labour is also proposing to increase income tax in Scotland by 1p across the tax bands. However, they are also proposing a £100 payment or rebate for those earning £20,000 or less. There is a separate debate over whether and how this can be implemented, but for our purposes we have assumed it is administratively feasible. Our analysis shows that the poorest 30 per cent of households would see increases in income under these proposals, with the richest paying significantly more than now (up to an additional £1,040 per year in the wealthiest 10 per cent of households).

- The Scottish Conservatives’ proposals are less specific, but they have proposed that Scotland’s tax take should not be higher than the rest of the UK and, when affordable, should be lower. The UK government plans to increase the higher-rate threshold to £50,000 per year, thus cutting taxes for higher earners. Our modelling of the effects of matching this tax cut in Scotland shows that increasing the 40p threshold to £50,000 in Scotland would result in no change for the poorest 30 per cent of households, a marginal tax cut for some middle earners, and a significant tax cut for the top 30 per cent of households.

It should be noted that matching UK government plans would happen by taking a ‘do nothing’ approach under existing powers (the approach we have seen since the Scottish parliament’s inception), as under current arrangements tax thresholds are set by the UK Government across the UK. Under potential new tax powers for Scotland, matching UK government plans would, in contrast, require an active decision. This means that, without new powers, Scotland’s progressives may only have the ‘devil’s choice’ of doing nothing, and thus passing on tax cuts for the highest earners, or doing something by increasing taxes across all bands, and thereby increasing tax for at least middle if not lower earners too. On the other hand, the proposed set of new powers would open up the possibilities for a more tailored, Scotland-specific approach to income tax. That is why the current UK and Scottish government negotiations are so critical.

So far the SNP and Scottish Greens have not made clear their plans for future income tax changes. We will no doubt see these once we know when or if new powers are coming to the Scottish parliament, and as manifestos are published in advance of May.

For Scotland, matching the UK government’s tax plans would reduce tax for the rich but not the poor; the proposals of the Scottish Liberal Democrats and Scottish Labour would increase tax on the rich but not on the poor. However, what is politically progressive or regressive – or as the term is sometimes used, what is right and wrong – is obviously more open to debate. Is it right or wrong to ask low and middle earners to pay more tax, regardless of how much more the richest pay? Is it right or wrong to leave tax rates as they are, limiting the ability to reduce spending cuts in Scotland? Is it right or wrong to match UK-wide tax cuts for middle and, particularly, higher earners at a time of benefits cuts and deep public spending cuts? In the event that new powers are not agreed, is it right or wrong to take a ‘do nothing’ approach on tax, allowing UK-wide tax cuts for the highest earners to be passed on in Scotland, or should Scotland instead take a ‘do something’ approach to try to mitigate that change?

Regardless of these judgments, the facts are clear in terms of who wins and who loses from the proposals we know about so far. Our future work will look at how much would be raised or lost through potential tax changes, within the context of the challenges facing Scotland in terms of public spending cuts and benefits cuts. Whether new tax powers for the Scottish parliament are agreed or not, the debate around tax in Scotland has begun in earnest. Where Scotland ends up, and the balancing of priorities between tax rises, benefits cuts and public spending cuts look set to dominate the election, and political debate, in the run-up to elections in May.

- Download the data from our analysis, based on the IPPR tax and benefit model

Related items

Reclaiming Britain: The nation against ethno-nationalism

How can progressives respond to the increasing ethnonationalist narratives of the political right?

Rule of the market: How to lower UK borrowing costs

The UK is paying a premium on its borrowing costs that ‘economic fundamentals’, such as the sustainability of its public finances, cannot fully explain.

Restoring security: Understanding the effects of removing the two-child limit across the UK

The government’s decision to lift the two-child limit marks one of the most significant changes to the social security system in a decade.