Competition policy: a toolkit for a fairer, more open and dynamic economy

Article

George Dibb, Head of the Centre for Economic Justice, IPPR; Barry Lynn, Director, Open Markets Institute; Max von Thun, Europe Director, Open Markets Institute; Nicholas Shaxson, Balanced Economy Project.

Competition policy can be one of the government’s most powerful policy toolkits, because it directly regulates the structure and operations of our markets and economy. As such, it lies at the heart of reform for a fairer economy, any serious industrial policy, and can be “a master narrative for democracy”.

Smart competition policy is a genuinely pro-business agenda that prioritises ordinary working people. If employed effectively, it can contribute to growth and prosperity, resilience, opportunity, security, diversity, fairness, sustainability, innovation, keeping inflation under control, freedom of expression, or good working conditions. It is smart electoral politics, and it can appeal across the political spectrum, and across the regions and devolved nations of the UK. Dominant firms like to claim that robust competition policy and enforcement mean the UK is “closed for business” - but the opposite is true. Competition policy is the foundation of an economy built on the creativity, investment, and innovation of the private sector. There is no road to prosperity that runs through concentrated markets.

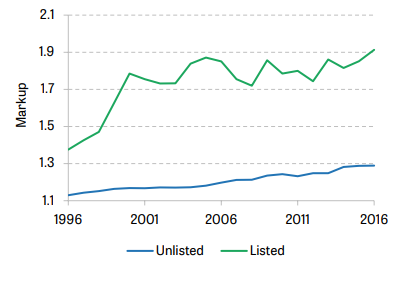

Figure 1: For decades British firms have been steadily increasing price mark-ups

Aggregate markups for British firms

Among affluent countries, the US has long been seen as the most afflicted by excessive concentrations of market power, with harm to productivity, stagnant real wages (especially for lower-income workers), rising markups of prices over costs, a falling share of labour in GDP and declining business dynamism. But studies by regulator the Competition and Markets Authority show that the UK is suffering too and growing worse. As a recent IFS study noted, “almost all of the US trends are present in the British data,” with high productivity among relatively few ‘superstar firms’ often happening at the expense of many smaller firms caught in their gravitational pull, harming economy-wide productivity overall. The IPPR Commission on Economic Justice highlighted the concentrated nature of key sectors of the British economy and the need to reform markets for openness and dynamism. A significant body of evidence for the US now points to the role of concentrated markets in facilitating rising profits and driving inflation– and the latest UK studies suggest a similar connection.

A global sea change begins

Internationally, competition policy (or “antitrust” in the US) is now entering a period of rapid flux. Traditionally, competition policy aimed to protect the interest of the individual as citizen, taxpayer, worker, and entrepreneur, and of the public as a whole. But in the 1980s, a small group of pro-monopoly scholars began to claim that concentration actually benefits individuals as “consumers” by empowering corporate managers to drive down costs, and hence prices. Not only did this thinking lead to waves of harmful consolidation, it also has meant competition authorities lacked the theoretical framework to tackle rising corporate concentration, especially in the digital economy.

In July 2021, the Biden administration in the USA decisively and explicitly repudiated the outdated paradigm, and enacted an Executive Order on competition mandating a whole-of-government approach to anti-monopoly. Biden also appointed leading anti-monopolists such as Lina Khan and Jonathan Kanter to key antitrust posts. US regulators have since made vigorous use of their tools, including blocking several high-profile takeovers and launching historic investigations into abusive conduct by ‘Big Tech’. Leading competition authorities around the world, including Australia, Germany, the EU and the UK, are moving in a similar direction, signalling the end of a decades-long toleration of rising market consolidation. Anti-monopolists see confronting concentrations of corporate power as being essential to promoting the interests of working people. Equally, the Biden administration has taken a new approach to trade and industrial policies as set out by Jake Sullivan, as ways to structure more resilient and diversified global markets.

Britain and the CMA - global leader in competition regulation

Britain is starting to carve out a space at the forefront of global efforts to tackle economic concentration and promote more competitive markets: most recently with the CMA’s decision in May 2023 to block the Microsoft/Activision merger, the publication of the ground-breaking Digital Markets, Competition and Consumers Bill, also announced this month, and a new Digital Markets Unit (DMU) to protect the integrity of digital markets.

These were not sudden developments, but the fruit of changes in the works for some time. The CMA has been building up its evidence base over years, including the 2019 report by the Digital Competition Expert Panel, landmark studies on concentration in digital advertising and mobile ecosystems, and broader data on rising market concentration. These changes were underpinned by leadership from former Chair Lord Tyrie and former CEO Andrea Coscelli, now taken forward by new CEO Sarah Cardell. This approach has been driven mostly by the CMA, not the government, which repeatedly dragged its feet in publishing long-promised legislation.

The CMA has learned lessons of past under-enforcement and a failure to stop dangerous and anti-competitive mergers, particularly in digital markets where a few platforms dominate, using their power to exploit consumers and small businesses and exclude rivals. This has hampered the development of the UK tech sector: startups feel that to grow they must either provide a satellite service to fit into Big Tech’s wider ecosystem, or be acquired by the giants.

The CMA is now taking a long-term perspective on competition, instead of a narrow view centred on the present shape of markets and technology. Until 2021, the largest big tech firms had made over 1,000 acquisitions and no regulator, anywhere, had blocked them. The CMA was the first to break ranks, forcing Facebook/Meta that year to sell Giphy – technically, the first ever global breakup of a merger by a “GAFAM” firm (Google, Amazon, Facebook, Apple & Microsoft). The recent decision on the Microsoft/Activision merger was another notable outcome of this wider perspective, as was its position on the Nvidia/Arm merger before it was abandoned. This stance is not restricted to tech. The CMA blocked the Asda/Sainsbury merger four years ago, and is targeting harmful consolidation in everything from vets and hearing aids to waste management and rail signalling.

Until 2021, the largest big tech firms had made over 1,000 acquisitions and no regulator, anywhere, had blocked them

The companies targeted and their advisers naturally oppose the CMA’s tougher stance, trying to portray it as anti-business and harmful to the UK’s tech aspirations. This is back to front: curbing the giants’ dominance is a pro-business approach that will give UK startups and other businesses breathing space, keep markets contestable and improve consumer choice while tackling exploitation.

Global competition trends are moving in one direction, and it will benefit the UK to stay at the forefront.

Further Reading from the UK:

Max von Thun (2023) The UK finally published its competition bill. Was it worth the wait?, Tech Policy Press.

Rocio Concha and Craig Beaumount (2023) Ministers should ignore critics and embrace stronger regulation of Big Tech, the Times.

HM Treasury (2019) Unlocking digital competition: report of the digital competition expert panel.

Tyrie A (2020) How should competition policy react to coronavirus?, IPPR.

Hayes C and Jung C (2022) Prices and profits after the pandemic, IPPR and Common Wealth.

Competition and Markets Authority (2022) State of UK Competition Report 2022, CMA.

Jan De Loecker, Tim Obermeier, John Van Reenen (2022) Firms and Inequalities, the IFS Deaton Review.

Further Reading from the USA:

Barry Lynn (2021) How Biden can Transform America, Washington Monthly. (A blueprint for the Biden reforms announced six months later)

Jake Sullivan (2023) A Foreign Policy for the Middle Class - Remarks by National Security Advisor.

Related items

Citizenship: A race to the bottom?

Who is losing learning? Finding solutions to the school engagement crisis

Reflections on International Women's Day 2025

In a world that currently seems increasingly dominated by ‘strong man’ politics and macho posturing, this International Women’s Day it seems more important than ever to take stock of where we are on the representation of women in politics.