Freezing council tax will make virtually no difference to households in poverty

Article

Instead of spending money on freezing council tax, the Scottish government should channel support directly to households struggling the most

At the recently concluded SNP conference, first minister Humza Yousaf announced a freeze on council tax in the next financial year, purportedly to bring “much needed financial relief to those households who are struggling in the face of rising prices.” Our analysis shows that the impact of the freeze on household budgets will be negligible, and a majority of those struggling households will see no benefit at all.

The Scottish government says it will “fully fund this freeze” – ie it will use its own already-overstretched budget to protect local services. Quite how much this translates into will depend on what the council tax rates would be without the freeze. We can expect local government, already furious at not having been consulted ahead of the announcement, to disagree with the Scottish government on what funding the freeze will amount to, not least because the Scottish government recently consulted on increasing council tax rates in the upper bands.

In any case, is freezing council tax across the board an effective way to help households that are actually struggling with higher prices? We do not think so.

Certainly, all households are experiencing higher prices. But in a country riven with inequality like Scotland, how exactly households might struggle with higher prices varies hugely with income. Freezing council tax across the board ignores this variation. Alongside some struggling households, the freeze will reduce the financial burden on wealthy households that have the resources to cope with higher prices. Extending support in this way to households that do not need it is bad enough. But what compounds the situation is that the council tax freeze will actually make no difference to the budgets of thousands of low-income households.

Over 400,000 households are already afforded some relief by the Council Tax Reduction (CTR) scheme. This reduces council tax liabilities based on a household’s income and their circumstances – such as disability and the number of children. Households receiving CTR either pay no council tax or pay an amount less than the full rate. What they are billed, crucially, is determined by their income, not the council tax rate. As CTR is means-tested it overwhelmingly goes to those households struggling most with increasing prices. As such, these households will see no benefit from the first minister’s proposed freeze.

We modelled the policy and found that the council tax freeze will have the least impact on those very struggling households that it aims to support. We compared the council tax freeze with a baseline assumption of a 5 per cent increase in council tax. This was the average increase last year and is a relatively conservative assumption given the ongoing cost pressures that councils themselves are facing. We asked what proportion of people in different groups would see any benefit from the policy.

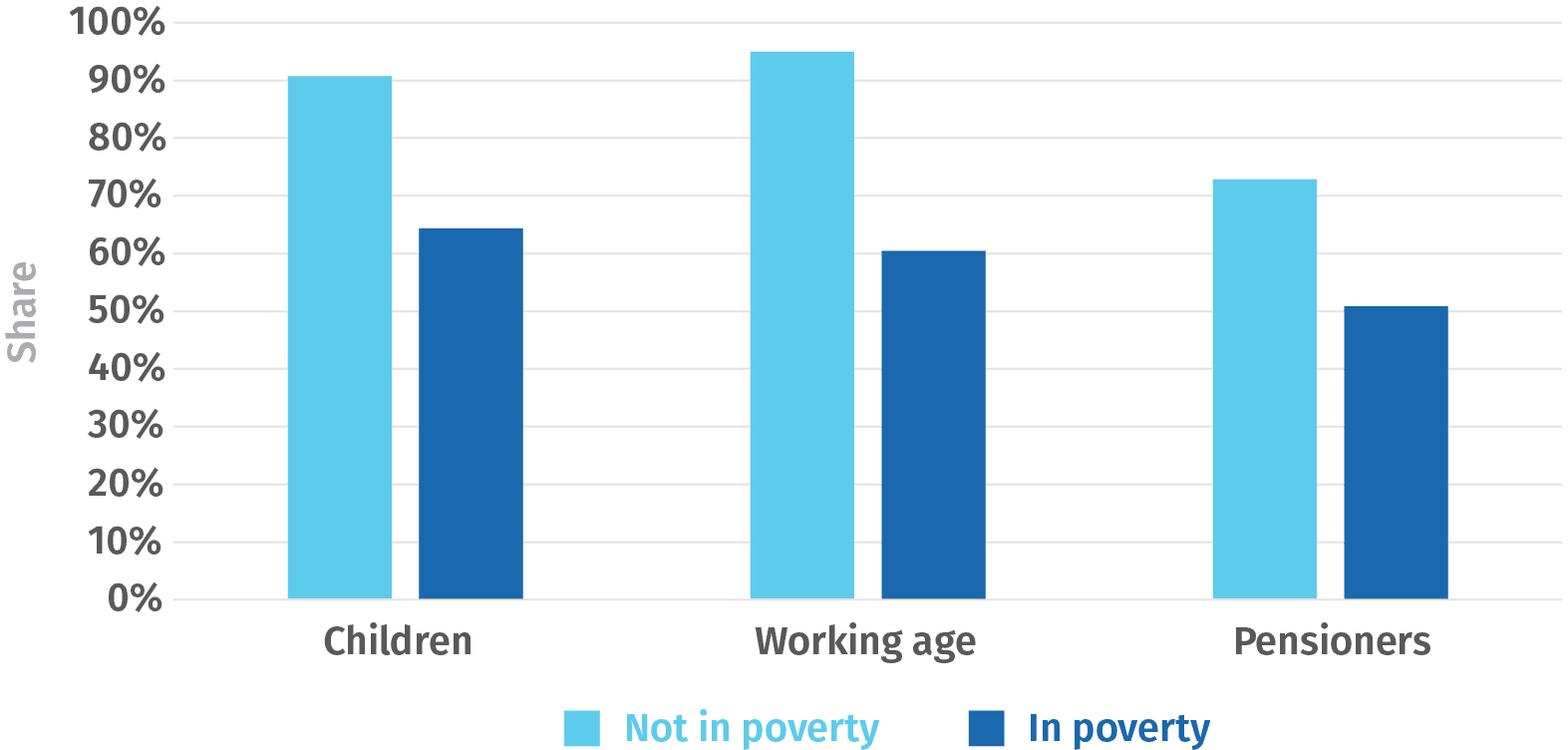

Figure 1: People experiencing poverty are less likely to benefit from the council tax freeze than people not experiencing poverty

Share of people in households paying less council tax due to the council tax freeze, against a baseline 5% increase in council tax rates

Source: IPPR tax and benefit model

While some of the benefit is indeed seen by households in poverty, they are much less likely to benefit from the council tax freeze than households with higher incomes. The freeze will reach around 65 per cent of children in poverty, as compared with 90 per cent of children not in poverty. Similarly, it will reach just 60 per cent of working age adults in poverty but 95 per cent of those who are not. Similarly, among pensioners, 50 per cent of those in poverty will benefit from the freeze, compared to 75 per cent of those who are not.

Based on our conservative assumptions, we estimate the freeze will reduce the council tax that households pay by around £100 million (after accounting for CTR). When we look at how much of this reduction will be seen by households in poverty, the figure is shockingly low, at just £10 million. Worse, households with children in poverty will together see only £3 million of these savings. By spreading the support so thinly, a £100 million council tax freeze will have as good as no impact on child poverty rates at all. As a way of using the Scottish government budget to help those struggling in the ongoing cost of living crisis, freezing council tax is a remarkably bad idea.

Based on our conservative calculation, funding the freeze will cost Scottish government the same £100 million that the households will save. Should councils successfully argue the freeze has a more significant impact – citing inflationary pressures, anticipated increases in upper band multipliers, or plans for more than a 5 per cent increase – the costs will be higher. The Fraser of Allander Institute estimate the shortfall could be as high as £417 million.

What else could Scottish government do with the amount of money it will spend on the freeze? One option would be to mitigate the two-child limit. During a parliamentary debate earlier this month the cabinet secretary for social justice described the two-child limit policy as “harmful and discriminatory”, while at the same time rejecting calls to use the Scottish budget to directly mitigate its impacts.

Another alternative to the freeze would be to increase the Scottish Child Payment (SCP), giving the money directly to households most likely to be struggling with increased prices. We estimate our conservative £100 million costing could boost the SCP by an additional £5.70 per child per week (on top of inflation), and this would lift around 10,000 children out of poverty, knocking almost one percentage point off the child poverty rate. This money would not only be vital support to the families in Scotland actually struggling, but its impact would also roughly be at the scale of change the Scottish government needs to deliver every year to drive the poverty rate below the 10 per cent statutory maximum in 2030.

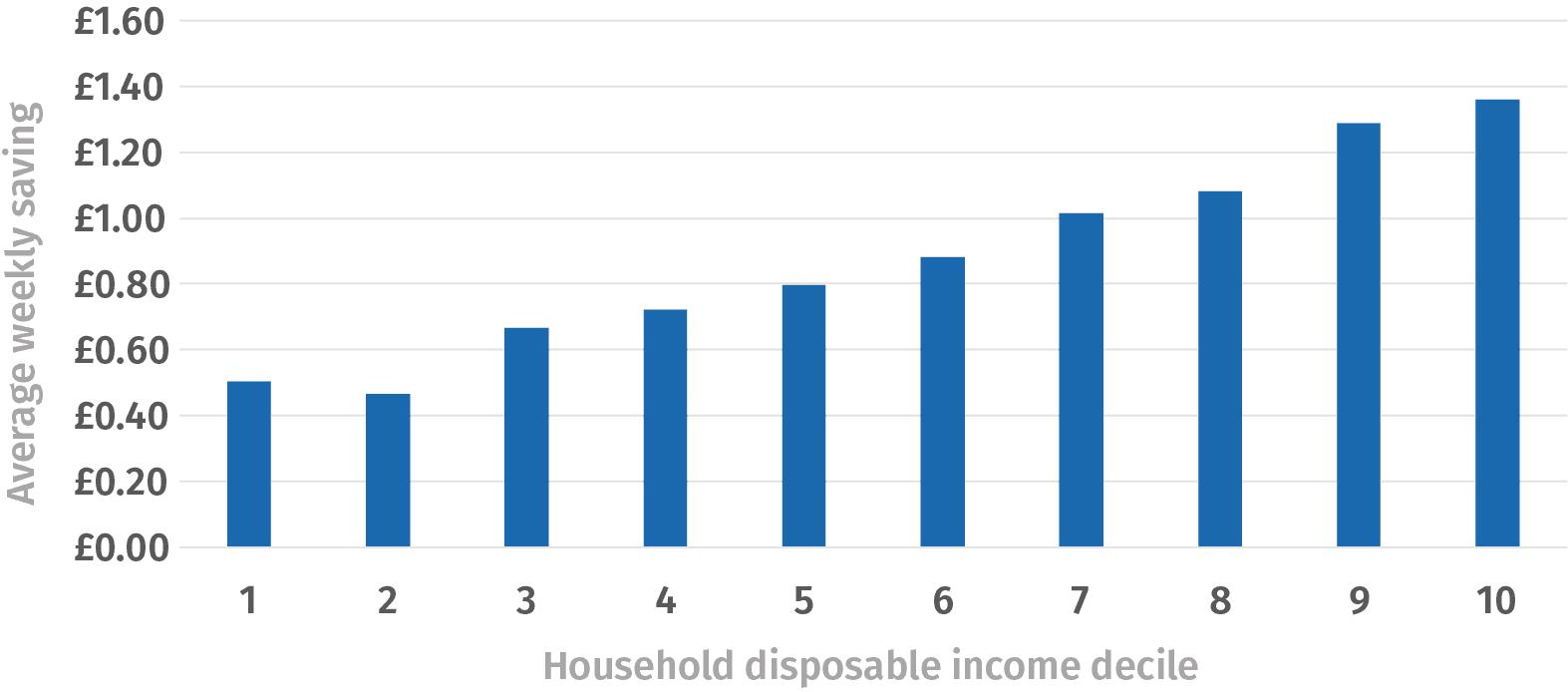

The Scottish government may well (indeed it should) be considering an uplift to the SCP in the forthcoming budget. However, whatever level it sets benefits at, the council tax freeze will soak up money that could be added to social security support. The freeze will do little for struggling families, providing a negligible saving (£1 per week on average) to many households who do not need help, and constraining support to those who need it the most.

Figure 2: Freezing council tax benefits higher income households more than low, but makes a very small difference to household budgets

Impact of council tax freeze on mean disposable income (after housing costs) across income deciles, including impact on Council Tax Reduction

Source: IPPR tax and benefit model

Tackling poverty is one of three defining missions of the Scottish government. However, at a time when progress on that commitment risks stalling and rates of destitution are rising, a freeze on council tax is an ineffective diversion. Spending over £100 million, possibly as much as £400 million, on a policy that most households won’t even notice, is a deeply questionable choice. The Scottish government should reconsider the freeze and use its budget far more wisely to support struggling households.