Second round effects: Why the OBR is likely underestimating the growth effects of public investment

Article

The Office for Budgetary Responsibility has outlined a new approach to modelling the growth impacts of public investment.

Unlike before, this allows them to better reflect the economic benefits of spending items, such as infrastructure investment, rather than just the costs of funding them. This is particular important given the new Labour government’s plan to raise public investment by an additional 0.7 percentage points of GDP annually over the next five years. This keeps public sector net investment (PSNI) stable, compared to the previous government’s plans under which it would have fallen by more than a third. The question though will be how much this might raise growth.

Today the OBR has, for the first time, explicitly used its new methodology to assess the GDP effect of the government's increase in public investment. This is hugely welcome. Their approach is thorough and a big improvement on the previous status quo that did not explicitly analyse the effects of public investment. They estimate that the level of potential growth will be 0.14 per cent higher than without the higher investment, clearly confirming the case that it is growth enhancing.

[The OBR's new] approach is thorough and a big improvement on the previous status quo

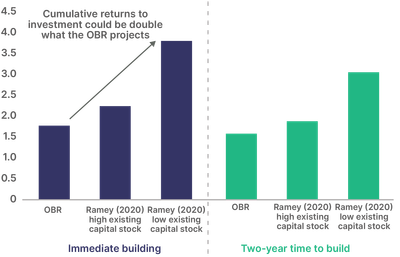

Their baseline estimate is based on underlying modelling that a 1 per cent increase in public investment, over a 10-year horizon, increases GDP by 1.8 per cent cumulatively. However, their methodology does not follow standard practice in the economic literature, which usually involves modelling the ‘second round effects’ in which businesses and households respond to higher public investment by increasing investment and labour force participation. These are known as the ‘general equilibrium effects’ of an increase an investment (see technical annex). The result is that the OBR’s longer-term returns to public investment are lower than those found in the literature (see Ramey). Instead of modelling how businesses respond, the OBR makes a ‘manual adjustment’ to business investment numbers, which seems low.

The recent US experience is instructive in this regard, with fiscal policy being expansionary and going hand in hand with strong manufacturing investment increase. Industrial policy spending crowded in a multiple of private investment (see Boushey and Clean Investment Monitor). Overall manufacturing investment tripled since the inception of Biden's industrial policy package, reversing years of stagnation. Blackrock calls this 'the rebirth of American manufacturing'. On the surface, this provides strong evidence that the Inflation Reduction Act and Biden's other two pieces of industrial policy legislation were able to crowd in private investment.

Overall manufacturing investment tripled since the inception of Biden's industrial policy package, reversing years of stagnation

In future work, the OBR could seek to model such general equilibrium effects in line with the economics literature, as it does better reflect how second round effects of productive public investment can lead to higher private investment, labour force participation and consumption).

The below analysis shows what how this could impact the OBR’s analysis. It builds on the analysis from Valerie Ramey - the leading US scholar in this field. It shows that more properly modelling the returns to public investment could yield more than double the overall returns than the OBR suggests, over a 10 year period. In the final year of the forecast, by 2029/30, the GDP impacts could be between 1.9 and 3.8 times higher than the OBR central case suggests. The upper estimate number could be more likely, given the low existing public capital stock in the UK, which according to much of the literature indicates that returns to investment should be higher (given diminishing marginal returns). Using the average of our upper and lower estimate, we find that potential output could be 0.39 per cent of GDP (£14 billion) higher in the final year of the forecast - almost three times the amount that the OBR projects as a result of the chancellor’s public investment increase.

Figure 1: Properly modelling general equilibrium effects mean that returns to investment could be more the double than what the OBR is expecting over a 10-year horizon

Cumulative per cent of GDP returns, of a 1 per cent investment increase, over 10 years

Technical annex

You might also like ...

The direction of AI innovation in the UK: Insights from a new database and a roadmap for reform

Recent developments in artificial intelligence could have transformative effects on the economy.

Planes, trains and automobiles: How green transport can drive manufacturing growth in the UK

Transport is essential to our lives. Unfortunately, it is currently also the largest source of UK domestic carbon emissions.

Harry Quilter-Pinner on BBC news discussing the Spring Statement