Spread capital ownership to build an economy that works for everyone

Spread capital ownership to build an economy that works for everyoneArticle

Labour and the Conservatives are currently searching for an answer to different questions: how to transform the economy on the one hand, and restore support among the under-45s on the other. Surprisingly perhaps, part of the answer to both lies in the same approach: to get serious about reshaping the distribution of capital and wealth in the economy.

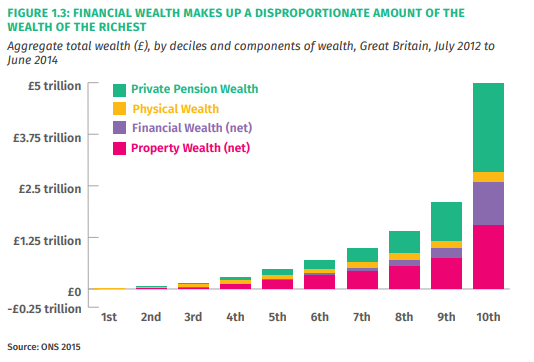

In a discussion paper for the IPPR’s Commission on Economic Justice, we have looked at the dimensions and drivers of increasing wealth inequality in the UK today. Our research shows that the wealthiest ten percent of households have in aggregate five times the wealth of the bottom half of households. What’s more, the share of total wealth of the top 10 per cent has been rising - from 46.7 per cent in 1984, to 51.9 per cent in 2013.

Understanding these inequalities and why they’re increasing requires looking at three different components of wealth: financial wealth, property wealth and pension wealth (we exclude other physical wealth as it is relatively evenly distributed, and data on its value is incomplete.)

The first of these is the most unequally distributed. One third of adults in the poorest fifth of households have no savings at all held for a ‘rainy day’ or unexpected expenses, and half of adults in this group have debts that are at least 83 per cent of their annual income. Household debt – negative financial wealth – is also rising. If recent trends in unsecured debt continue, the average household in ten years will have 39.8 per cent more unsecured debt than the average household today. By contrast, at the top end of the distribution, the 10 per cent wealthiest UK households directly own an estimated 77 per cent of all stocks and 64 per cent of bonds. This matters hugely, because equity returns have been higher than economic growth and wage growth in recent years: the average quarterly net rate of return for private non-financial corporations between 2007 and 2017 was 12.02 per cent, while wages are experiencing their longest period of sustained stagnation in 150 years.

The other major driver of rising inequality since the recession has been the property market. Home ownership grew among all regions and income groups during the 1990s and early 2000s, helping to compress wealth inequality. However, home ownership has been falling since the mid-2000s and is now at its lowest rate for almost three decades. While home ownership among the least wealthy 50 per cent has fallen by around 12 per cent since the financial crisis, for the wealthiest 10 per cent it has continued to rise by 1 per cent. The top 10 per cent now have property wealth averaging £420,000 in value, compared to the average household in the bottom 50 per cent having no property wealth at all.

Finally, pension wealth is also highly unequal; the top ten per cent have on average £748,700 in pension savings, compared to an average of £2,800 for households in the bottom half. Some of this is accounted for by age, as people nearing retirement have the highest pension pots, and automatic enrolment should reduce inequalities in time. However, stagnating average pay and the prevalence of insecure work are likely to make it harder for growing numbers of people to save for a pension, and it’s still the case today that the average man retires with a pension pot 4 to 5 times the size of the average retiring woman.

These disparities in wealth are particularly concerning in the context of technological trends in the economy. Automation of labour risks increasing wealth inequality in two ways. Firstly, by creating highly rewarded jobs that are complemented by technology, and a residual of poorly paid, low-quality jobs. Secondly, where labour is substituted for machines, this shifts the distribution of income towards capital relative to labour. The IMF estimates that half of the fall in the wage share since the 1980s has been driven by technological change. If automation further increases the share of national income going to capital, this is likely to increase the wealth of capital owners. The rise of digital platforms also risks concentrating wealth, particularly as powerful network effects mean they trend towards becoming monopolies, generating ever-greater rewards for a small number of ‘super star’ firms and their founders.

Increasing returns to capital, diverging property wealth, and a growing capital income share, mean a response focussing on waged labour and increasing labour income will not be sufficient to tackle inequality. To make sure the economy works for all, progressives should look to spread ownership of capital.

This doesn’t have to mean a Thatcherite effort to create a ‘share-owning democracy’, not least because the consensus mechanisms used to disperse wealth have actually lead to a concentration of capital and declining home ownership rates. There are a range of policy options to create broadly shared capital ownership that provides everyone with a stake in the economy and enables everyone to share in the returns to capital. These include encouraging or mandating employee ownership at the firm or sector level, supporting the cooperative and mutual sector, and creating a Sovereign Wealth Fund that invests in strategic sectors. Other options are building more affordable housing, and capturing the uplift in the value of land following public investment. Finally, smarter, fairer wealth taxation could support more productive investment and share unearned returns to wealth. The IPPR Commission on Economic Justice will be exploring all of these in the coming months. If we are to build an economy that works for everyone, we have to spread the ownership of capital at scale.

Carys Roberts is a Research Fellow at IPPR. She tweets @carysroberts.

This blog originally appeared in Prospect Magazine.

Related items

Who gets a good deal? Revealing public attitudes to transport in Great Britain

Transport isn’t working. That’s the message from the British public. This is especially true if you’re on a low income, disabled or living in the countryside. The cost of living crisis has exposed the shortcomings of our transport system,…

Bhargav Srinivasa Desikan on TalkTV discussing AI

IPPR's Bhargav Srinivasa Desikan on TalkTV discussing his new report on the impact of generative AI on the UK labour market.

Transformed by AI: How generative artificial intelligence could affect work in the UK – and how to manage it

Technological change is a good thing. It has brought exponential gains to living standards and is the foundation of modern society. Yet unmanaged technological change has always come with risks and disruptions.