Budget puts Starmer on course to be the highest investing PM since the 1970’s, IPPR finds

30 Oct 2024Press Story

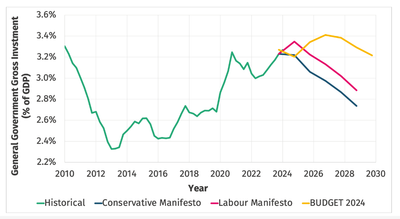

- Increase in gross public investment of £66 billion over parliament since last OBR forecast

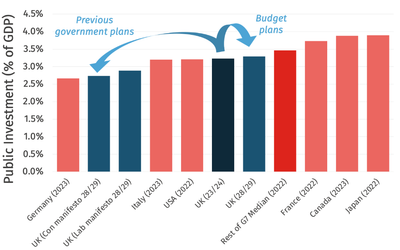

- New plans halt the UK’s planned fall down the G7 rankings on public investment

- OBR underestimates the boost this will bring to economy and tax revenues, says IPPR

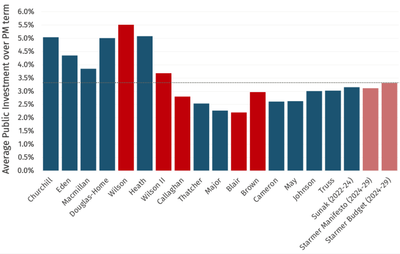

Measures to boost public investment in today’s budget reverse planned cuts and mean the Starmer government is forecast to deliver the highest average level of public investment of any prime minister since Harold Wilson in the 1970’s, IPPR analysis has found.

Total gross public investment is now projected to be £66 billion higher over this parliament, compared to the OBR forecast made at the time of the March budget.

Pre-budget plans by both the Conservatives and Labour parties in their manifestos would have left the UK tumbling down the international league table on public investment. It is already at the bottom of the league among G7 economies for overall investment (public and private). But on the government’s new plans, the UK will approach the average public investment level of other G7 economies in the middle of the parliament.

IPPR has also calculated that the planned increase in public investment could boost the economy by 0.39 per cent of GDP (£14 billion) in the final year of the forecast - almost three times the amount (0.14 per cent of GDP) that the OBR projects as a result of the increase. This is because the OBR uses, in light of the economic literature, an unduly pessimistic model to estimate the impact of public investment. It does for instance not clearly model the private investment it triggers – so-called ‘crowding in’.

The higher projection for GDP growth would also mean higher tax revenues for the government over the years ahead, enabling it to increase day-to-day spending on public services further without raising tax rates.

Going forward, the OBR‘s baseline estimate should more explicitly model the second round effects of productive public investment, which leads to higher private investment, labour force participation and consumption. A short paper setting out the case for rethinking the OBR’s modelling is published by IPPR today (see Note 1).

Dr George Dibb, associate director for economic policy at IPPR, said:

“Today the chancellor has rightly halted the planned cuts to public investment that now looks set to stay broadly constant over the parliament. To find a historical comparator to Reeves and Starmer on public investment you have to go back to Jim Callaghan and Harold Wilson in the 70’s.

“The chancellor’s sensible change to modernise the UK’s fiscal rules has opened the way to an ambitious path to greater public investment – holding us steady in the G7 league instead of falling behind Italy and the USA.

“After at least a decade of under-investment, there is now real hope that the government can start to fix the UK’s economic foundations.”

Carsten Jung, IPPR’s head of macroeconomics, said:

“It is excellent news that the government is significantly boosting public investment compared to its previous downward trend. Strategic investment has the potential to significantly increase growth, as the recent bumper growth experience in the USA has shown. The USA has left European economies in the dust through bold industrial strategy investment and other fiscal policy support.

“The OBR has made great strides in improving its modelling of the benefits of public investment, but it is still making very conservative assumptions of the impact of such investments on the wider economy. In particular, it needs to further model the second round effects of public investment on business decisions. Doing so would show more clearly the growth benefits of a bold investment agenda.”

ENDS

Dr George Dibb and Carsten Jung are available for interview

CONTACT

David Wastell, Director of News and Communications: 07921 403651 d.wastell@ippr.org

Georgia Horsfall, Digital and Media Officer: 07931 605737 g.horsfall@ippr.org

NOTES TO EDITORS

- IPPR has published a short paper exploring the GDP boost resulting from today’s budget, at https://www.ippr.org/articles/second-round-effects

- Other recent IPPR publications relevant to investment decisions in today’s Budget include:

- On how to modernise fiscal rules to enable vital public investment: Budgeting better: How the UK could start to improve its fiscal framework and boost growth - https://www.ippr.org/articles/...;

- On how the UK has lagged other G7 economies for investment: Rock bottom: Low investment in the UK economy - https://www.ippr.org/articles/rock-bottom - CHART: Change in public investment as a percentage of GDP since 2010, comparing 2024 budget change vs Conservative and Labour manifestos

Note: The measure of public investment here is general government gross investment.

Source: IPPR analysis of OBR and ONS data

4. CHART: Comparison of public investment under different historic British prime ministers

Note: The measure of public investment here is general government gross investment.

Source: IPPR analysis of OBR and ONS data

CHART: Change in projected UK public investment ranking among G7 economies, compared to pre-Budget projection

Note: The measure of public investment here is general government gross investment.

Source: IPPR analysis of OBR, ONS, and OECD data