George Osborne’s budget means poorest Scottish families will lose more than £500 per year – IPPR Scotland

12 Oct 2015Press Story

A greater number – 1.3 million – will gain from the Budget, but these households are concentrated in the top 40% of the income distribution.

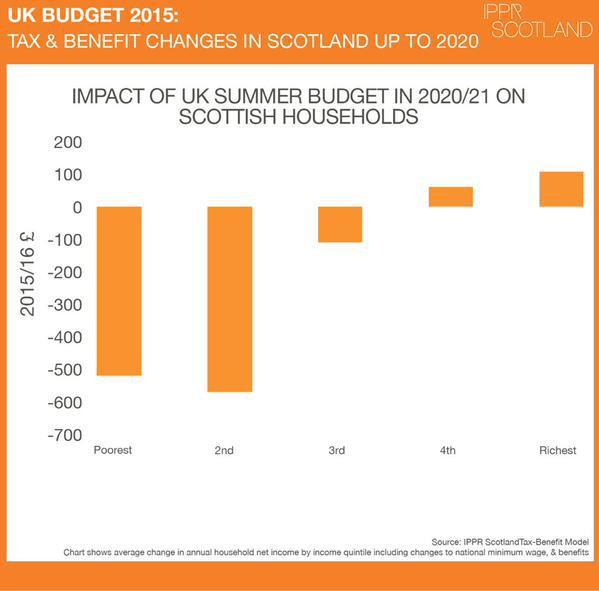

The poorest 20 per cent of Scottish households are expected to lose an average of £520 per year by 2020. Our analysis, using the IPPR tax-benefit model, shows that the rise in the National Minimum Wage for over 25s, and announced tax cuts, are vastly outweighed by reductions in tax credits.

This is the first time that the impact of the budget has been analysed for Scotland, rather than the UK as a whole. Comparing several aspects of George Osborne’s budget, the analysis found that the poorest two-fifths of Scottish households will be hit hardest.

The research found:

• On average, Scottish households will be £210 a year worse off in 2020 as a result of measures in the summer budget.

• The poorest 20 per cent of Scottish households will lose an average of £520 a year by 2020/21.

• Those in the top 20 per cent of Scottish households will actually gain £110 a year by 2020/21.

• The biggest losers by far will be lone parents in Scotland, who are expected to lose over £1500 on average, followed by couples with children who will lose an average of £540 a year.

• There will be more winners (1,300,000) than losers (800,000) from the changes, but the households who gain are concentrated in the top 40 per cent of the Scottish income distribution.

• Those households who see a drop in income will lose an average of £830 per year, whereas those gaining will be on average £170 better off by 2020, both from the rise in the National Living Wage and income tax cuts.

Russell Gunson, director of the newly-launched IPPR Scotland, said:

“This is the first time that a tax and benefit analysis of George Osborne’s budget has been applied to Scotland and it shows his decisions will have a huge impact on the poorest in Scotland. Over 800,000 households will be worse off, with some losing over £500 per year. We have heard a lot about the positive impact of the rising National Minimum Wage, but for low and middle income Scottish families this is vastly outweighed by the negative impact of tax credit reductions.

“This may be a decision that was made in Westminster, but how it can be reversed in Scotland is a clear challenge to the whole of the Scottish Parliament. As we look ahead to the Scottish Parliament making its spending decisions over the coming months, everyone must have the effects of these decisions, and in-work poverty more generally, in the forefront of their minds.”

Contacts:

Russell Gunson – r.gunson@ippr.org 07766 904 332

Danny Wright – d.wright@ippr.org 07887 422 789

Sofie Jenkinson – s.jenkinson@ippr.org 07981 023 031

Lester Holloway – l.holloway@ippr.org 07585 772 633

Notes to Editors

IPPR Scotland is a new, non-partisan think-tank working on public policy in, and for, Scotland.

IPPR Scotland will conduct and publish research, hold events and engage in widespread dialogue on the issues that really matter for Scotland’s social, economic and political future. In all its work, it will be guided by the goals of social justice, democracy and sustainability.

Its programme of research will take shape in the coming months, but early reports will focus on the Scottish labour market, the country’s future skills needs and the tax and spending choices available to the Scottish Government.

IPPR Scotland’s first director is Russell Gunson. Russell previously worked for NUS Scotland for six years, joining as Head of Policy and Public Affairs before taking up post as NUS Scotland Director in 2014. Prior to working for NUS Scotland, Russell worked in parliament, government the voluntary sector and the private sector. Russell is also a Commissioner on the Commission on Widening Access, an independent commission Chaired by Dame Ruth Silver and announced by Nicola Sturgeon, Scotland’s First Minster, late last year. http://www.ippr.org/news-and-media/press-releases/leading-think-tank-ippr-appoints-first-scotland-director

Modelling for the IPPR's tax-benefit calculations were also used in our recent report on the impact of George Osborne's budget and his choices in next months' spending review. See 'The chancellor’s choices: How to make the spending review as progressive as possible while still delivering a surplus' http://www.ippr.org/publications/the-chancellors-choices

The IPPR’s tax-benefit calculations include the following measures announced at the Summer 2015 budget:

- Cuts to the income disregard in tax credits and the work allowances in Universal Credit

- Freezing working-age benefits for four years from April 2016

- Removing entitlement to the family element for new claims or new families entitled to UC or tax credits from April 2017; and

- Limiting support from Child Tax Credit or the child element of UC to two children for new claims or births from April 2017

- The introduction of a National Living Wage, expected to rise to £9 an hour by 2020

- A rise in both the personal allowance and the higher rate threshold of income tax

We assess the combined impact of these measures (before housing costs) on Scottish Households in 2020, with our figures deflated to 2015/16 prices. The model looks solely at the initial impact of the summer budget announcements, before considering any change in household’s behaviour (such as the National Living Wage as an incentive for individuals to move into work).