IPPR Scotland budget response: Hunt’s tax giveaway benefits the richest in Scotland and threatens public services

7 Mar 2024Press Story

- New analysis from IPPR Scotland shows that only 2p in every pound the chancellor plans to spend reducing national insurance in Scotland goes to the poorest 20%

- The average employee in Scotland saves just under £1 per day.

- On average, households in Scotland see a £436 lower annual tax bill – compared with £621 in London.

IPPR Scotland’s analysis of the “slash-and-crash" UK Spring Budget has revealed that the chancellor’s two pence cuts to employee and self-employed national insurance contributions primarily benefit households with the highest incomes in Scotland.

Using the latest OBR data to analyse the cut, which the UK government estimates will cost £10.1bn in 2024/25, IPPR Scotland finds that, for workers in Scotland, just 2p in every pound the chancellor plans to spend reducing national insurance in Scotland goes to the poorest 20%

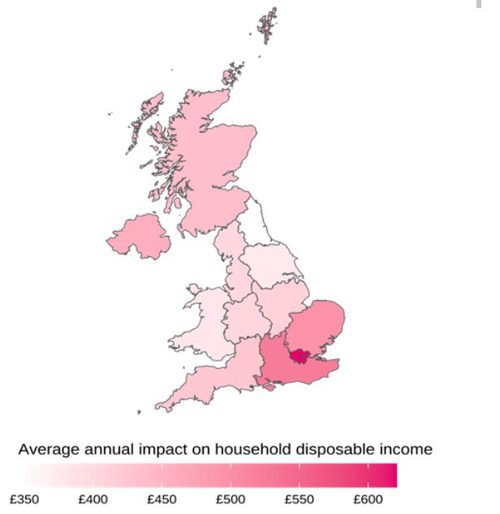

Meanwhile, the geographical distribution of benefits of the changes also skew towards London and the South East of England. On average, households in Scotland see a £436 lower annual tax bill – compared with £621 in London.

Geographical distribution of average household tax savings

Region | Average household benefit from 2p national insurance cut |

London | £621 |

South East | £525 |

Eastern | £495 |

Northern Ireland | £456 |

Scotland | £436 |

South West | £424 |

East Midlands | £409 |

West Midlands | £403 |

North West | £401 |

Wales | £380 |

Yorks and Humberside | £377 |

North East | £346 |

Source: IPPR Tax and Benefit Model

IPPR Scotland argues that the headline tax cut comes at the expense of public service spending – with ‘unprotected’ departments set to face significant cuts over the next five years, which risks consequential funding for Scottish public services.

Dave Hawkey, senior research fellow at IPPR Scotland, said:

“The chancellor has chosen tax cuts over public services, with future spending plans that simply aren’t credible.

“The biggest winners from the national insurance cut in Scotland are the richest, and across the UK the gains are highest in London and the South East of England. Hunt is paying for this tax giveaway with a massive spending squeeze, which risks crashing public services and cutting much-needed funding for Scotland.

“With a spending crunch looming, we need politicians right across the UK to get serious about credible tax and spending plans from the UK government, and a laser focus from the Scottish government on tackling the two biggest challenges we face today: the climate crisis and child poverty.”

AVAILABLE FOR INTERVIEW

Dave Hawkey is available for interviews

CONTACT

Sukhada Tatke, Media and Impact Officer: 07901169121 s.tatke@ippr.org

NOTE TO EDITORS

IPPR Scotland is an independent charity dedicated to shaping public policy in pursuit of a fairer, greener, more prosperous Scotland. Through policy, research, and communications, we work to create tangible progressive change, and turn bold ideas into common sense realities. We are deeply connected to the people of our nations and regions, and the issues our communities face. It is part of the UK-wide IPPR family.