National insurance cut would disproportionately benefit highest earners and Londoners, finds IPPR

10 Jun 2024Press Story

- Reported Conservative election promise to cut NICs by 2p would cost the Treasury at least £10bn

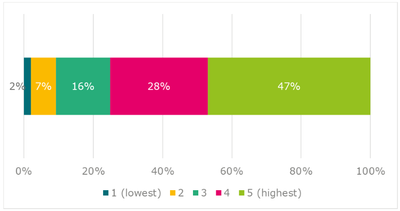

- For every £1 spent on NICs cuts, 47p would go to the highest earning households

- National insurance cuts would disproportionately benefit households in London and the South East

A two pence cut to National Insurance Contributions (NICs) for employees and the self-employed would cost the Treasury at least £10 billion next financial year, according to new analysis from IPPR.

A worker on median pay would benefit by £325 a year – or £6.25 a week.

However, the majority of the benefit of such a tax cut would go to the highest earners in the UK. For every £1 spent on NICs cuts, 47p would go to the highest earning fifth of households, while only 2p would go to the poorest fifth.

Distribution of reduced tax across household income quintiles

Source: IPPR Tax and Benefit Model

Additionally, those in London and the South East would see the greatest benefit. Working age households in London benefit by an average of £227 more than households in the North East.

Working age households in each region would benefit by an average of:

- London - £620 a year

- South East - £574 a year

- East of England - £539 a year

- Northern Ireland - £490 a year

- Scotland - £473 a year

- South West - £471 a year

- East Midlands - £459 a year

- Yorkshire and the Humberside - £431 a year

- West Midlands - £430 a year

- North West - £427 a year

- Wales - £417 a year

- North East - £393 a year

The cost of cutting NICs by 2p for workers would cost the Treasury at least £10 billion in 2025/26. Such a pledge may need to be funded by cuts to public services.

Recent polling shows that most Britons would prefer the government prioritise public spending over tax cuts. This has also been echoed by the International Monetary Fund.

Dr George Dibb, associate director for economic policy at IPPR, said:

“Tax has been a huge talking point of this election, for better or for worse. What is absolutely clear is that any potential cut to National Insurance would predominantly benefit the highest earners, and those in the most affluent parts of the UK.

“It is also clear that such a huge tax cut will need to be properly funded if we want to avoid another crisis like the one that followed the mini-budget in 2022. Polling is clear that the public don’t want to see tax cuts that mean further cuts to already desperate public services like the NHS.”

ENDS

Dr George Dibb is available for interview

CONTACT

Liam Evans, Senior Digital and Media Officer: 07419 365334 l.evans@ippr.org

NOTES TO EDITORS

- IPPR has modelled a 2p cut to NIC’s for the 2024/25 financial year, however it is unclear when such a cut may take place if the Conservatives win the election

- IPPR (the Institute for Public Policy Research) is an independent charity working towards a fairer, greener, and more prosperous society. We are researchers, communicators, and policy experts creating tangible progressive change, and turning bold ideas into common sense realities. Working across the UK, IPPR, IPPR North, and IPPR Scotland are deeply connected to the people of our nations and regions, and the issues our communities face. We have helped shape national conversations and progressive policy change for more than 30 years. From making the early case for the minimum wage and tackling regional inequality, to proposing a windfall tax on energy companies, IPPR’s research and policy work has put forward practical solutions for the crises facing society. www.ippr.org