UK's tax obsession debunked: most advanced economies with higher taxes than UK have higher income growth

27 Sept 2023Press Story

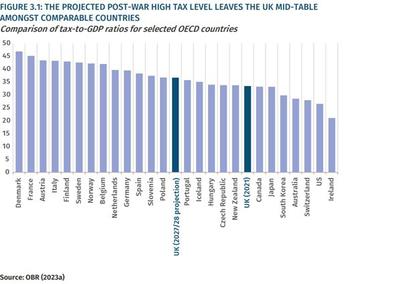

- Tax level in UK is lower than many advanced economies, and projected ‘record’ level by 2027 would raise UK only to ‘mid-table'

- International comparisons show that UK tax levels are not a barrier to wage growth and higher incomes, says IPPR report

- Upside of tax: higher taxes to strengthen public services and new net-zero industries would be popular and unlock sustainable growth

Setting an arbitrary ceiling on the so-called tax share of the UK economy risks hampering national growth and prosperity, according to a new report by IPPR.

Not only does the UK have relatively lower tax levels than most economically advanced countries, but many nations with higher tax rates have enjoyed stronger real wage growth and greater average disposable incomes.

Even if the UK reaches projected record levels of post-war taxation in four years’ time, IPPR says it would remain in the “middle of the pack” within the OECD economic organisation, whose 36 members produce around 60 per cent of global output.

Failing to invest more now in the infrastructure, targeted industrial development and public services needed to support a healthy, well-educated and flourishing workforce would leave the UK at risk of falling further behind through slower growth, the report concludes.

IPPR’s paper argues that the UK can have higher levels of tax at the same time as higher prosperity and growth – and that, given the current poor state of public services, the higher spending that taxes would support is essential to restoring growth.

It lays bare the truth about the UK’s economy compared to those of other advanced economies and finds that:

- Many advanced economies including Germany, Denmark and France have higher average disposable incomes than the UK, whilst also having higher tax levels.

- Advanced economies have increased their tax levels steadily since the 1960s, leaving the UK an outlier - in that our tax levels have increased more slowly.

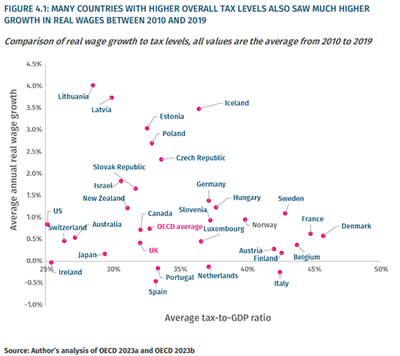

- In recent years, tax levels have not had a significant relationship with real wage growth. Many countries with a higher average tax level between 2010 and 2019 also saw higher growth in real wages over that period. Some countries with lower tax levels also saw lower wage growth.

- If the overall UK tax level rises as projected, from 33.5 per cent of total output (GDP) to 37.7 per cent (largely to cover higher debt interest payments and other costs), the tax take would still be lower than in countries with higher wage growth over the past decade – including France, Sweden and Germany.

The report argues that well-funded public services provide many of the building blocks for economic opportunity and prosperity. However, it points out that between 2010 and 2019 public spending as a proportion of GDP was cut from 46 per cent to around 39 per cent.

The report says that – contrary to claims made by anti-tax campaigners and others - failure to raise taxes fairly to the higher level needed to support more effective public services will damage UK prosperity.

To support what the report calls “smarter spending”, it also proposes changes that would deliver “smarter taxes”, including equalising taxes on wealth with taxes on income.

Pranesh Narayanan, research fellow at IPPR, said:

“The fixation on overall tax levels is a distraction from the real issues. The likes of Germany and France, and many other advanced economies, have seen sustained growth in incomes whilst maintaining much higher tax levels than the UK.

"Labour shortages driven by rising long-term illness, high energy prices and crumbling schools are bigger barriers to growth in the UK. Even fiscally cautious organisations such as the IMF are recommending higher spending on health, education and net zero to unlock sustainable growth. Within this context, higher tax levels will ensure that the government can deliver high quality services.”

Dr George Dibb, head of the centre for economic justice at IPPR, said:

“The politicians and journalists of Westminster are obsessed with the UK’s levels of tax, or – to use the heavily critical phrase – tax ‘burden’. We argue this fixation is a mistake. Far more important is who is paying tax and what those tax revenues are being spent on.

“The UK faces a multitude of challenges but they won’t be solved by cutting taxes. In fact, from too many people unable to work because of illness to our dysfunctional transport infrastructure, more revenues to fund better public services can help solve our economic woes. Not only that, the public broadly support fairer tax rises that fall on those who have weathered recent crises the best, with revenues spent on improving public services.”

ENDS

Pranesh Narayanan, the report’s author, and Dr George Gibb are available for interview

CONTACT

Liam Evans, Senior Digital and Media Officer: 07419 365334 l.evans@ippr.org

David Wastell, Director of News and Communications: 07921 403651 d.wastell@ippr.org

NOTES TO EDITORS

- The IPPR paper, Fairer taxes, smarter spending: A recipe for sustainable growth by Pranesh Narayanan will be published at 0001 on Wednesday September 27 at https://www.ippr.org/publications/fairer-taxes-smarter-spending

- Advance copies of the report are available under embargo on request

- Figure: Comparison of tax-to-GDP ratios for selected OECD countries

- Figure: Comparison of real wage growth to tax levels, all values are the average from 2010 to 2019

- IPPR (the Institute for Public Policy Research) is an independent charity working towards a fairer, greener, and more prosperous society. We are researchers, communicators, and policy experts creating tangible progressive change, and turning bold ideas into common sense realities. Working across the UK, IPPR, IPPR North, and IPPR Scotland are deeply connected to the people of our nations and regions, and the issues our communities face. We have helped shape national conversations and progressive policy change for more than 30 years. From making the early case for the minimum wage and tackling regional inequality, to proposing a windfall tax on energy companies, IPPR’s research and policy work has put forward practical solutions for the crises facing society. www.ippr.org